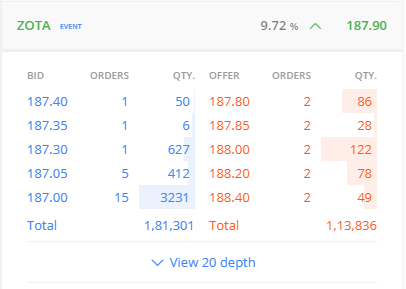

The screenshot below is the common 5 level order-book you find on almost all retail trading platforms in India, except for Zerodha’s kite trading platform.

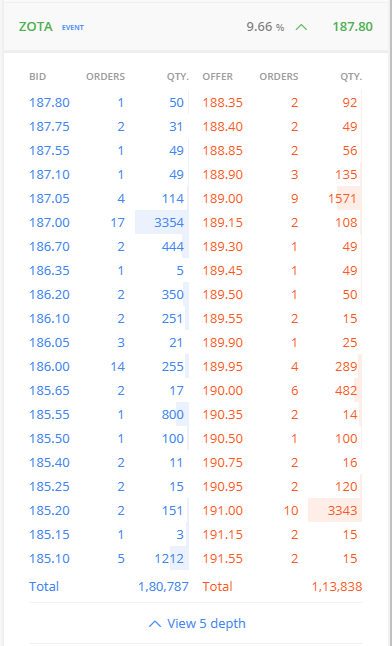

Here is the advanced 20 level order-book viewing facility available on Zerodha’s kite trading platform.

Say, for example you want to place a buy order for 1000 shares of this particular instrument on the screenshot.

By looking at the 5 level order-book on old school trading platform’s, all you know is you have a total of 363 quantity available on offer up to a price of 188.40.

From the information available to you on the 5 level order-book you can never guess if you place a market order, at what price is your order likely to get filled above 188.40. It could be at 189 or it could be at 200 or maybe even more. You might even end up buying something at a higher price than what you intended to pay.

Meanwhile having access to the advanced 20 level order-book on Zerodha’s Kite Trading platform, gives you a wider picture on the liquidity of these instruments. You can also be informed in advance on at what prices offers are available above the 5 levels. It even helps you decide on the maximum limit price you can set on a limit buy order so your instrument gets filled fully at a price you are happy to pay.

Mind blowing features, isn’t it?